Spiral Theory™

Is debt risky, beneficial, or both? Traditional portfolio theory—and conventional wisdom—treats debt as always risky. Yet in corporate finance, Modigliani and Miller showed that debt is central to value creation. Individuals are not companies, but it is inconsistent to argue that any debt, at any rate, at any time, is always “bad.” Simple examples disprove that.

The breakthrough of Spiral Theory™ is that debt, like a particle in superposition, can exist in two states: risky in the moment yet beneficial to outcomes over time.

By recognizing that investors can actively control their Quantity of Money™—borrowing when conditions warrant—debt becomes a negatively correlated asset, the missing third dimension of wealth management.

Once understood, this can systematically reshape probabilities of success, just as Modigliani–Miller once transformed corporate finance.

Debt, like Schrödinger’s cat, exists in two states at once.

It can be simultaneously risky and improve outcomes.

Spiral Theory™:

All Investors can benefit from the episodic use of debt

At a glance

Basic Math: If the expected return is zero—like flipping a coin—time and money don’t matter. But if the return isn’t zero, both time and quantity of money shape your outcome. That’s not opinion. It’s math.

Spiral Theory™: A hidden cost of investing is volatility drag—the mathematical reality that actual returns lag expected returns for all investors except those 100% in cash. Spiral Theory shows that, like a keel on a boat, managing your Quantity of Money™—through the episodic use of debt—can offset this drag. For the average person, the value is equivalent to a dozen additional working years.

The fact that volatility drag can be eliminated is not conjecture; it is a mathematical identity, and you will be able to simulate it later on this page.

Capital Structure Matters: In theory, capital structure doesn’t matter. In real life, it does. Frictions—like taxes, risk, and liquidity—make structure critical. Companies manage this carefully. People should too.

Total Economic Value™: Enterprise Value measures a company’s size. Total Economic Value™ does the same for individuals: assets + debt – idle cash. It’s not about maximizing it—it’s about using your balance sheet wisely for growth and, perhaps more importantly, protection.

Structural Debt = Hidden Superpower: A mortgage + an equal amount in the risk-free asset gives you a costless, perpetual option to invest. That flexibility grows more valuable when markets fall. Used wisely, it’s your airbag and parachute in one.

Volatility Drag Is the Enemy: Up-and-down returns erode wealth over time. Debt used recklessly makes it worse. But used strategically, it can reduce drag and stabilize outcomes—especially during major downturns.

Two Types of Debt, One Goal: Strategic and structural debt serve different purposes. Used together, they help grow wealth more efficiently and reduce risk.

The open question—the true “theory”—lies in the constraints and in how best to execute this in practice. The implication is transformative: debt is no longer viewed solely as risk, but as a stabilizing force that reshapes personal finance and reframes the way investors pursue outcomes.

Overview of Spiral Theory™

Executive Summary

Spiral Theory™ shows that, like a keel on a boat, managing your Quantity of Money™ can turn debt from pure risk into a stabilizer—transforming volatility from a hidden cost into energy that improves outcomes.

Most investors know the rule of thumb for retirement: the 4% rule. Withdraw about 4% of your portfolio each year and you should be able to make your money last. But here’s the puzzle: if equities return around 10% a year over the long run, and inflation averages 4%, shouldn’t you be able to spend closer to 6% in real terms? Why is the safe number so much lower?

The answer is volatility. Equities don’t move in a straight line—they go up and down. When markets rise, portfolios recover. But when they fall, especially at the wrong time, the damage can be permanent. For a retiree withdrawing money, a bad sequence of returns can turn an average outcome into running out of money. Even if you eventually get the “average” return, the path matters. This hidden cost is called volatility drag. It quietly reduces wealth by 1–2% a year. Over a lifetime, that can mean working a dozen extra years or retiring with far less freedom to spend.

Spiral Theory™ eliminates this drag. The breakthrough is simple but powerful: investors can actively control their Quantity of Money™. That means borrowing when conditions are favorable, or reducing exposure when needed. What traditional finance views as only “risky”—debt—can instead stabilize the journey.

Think of a sailboat. Without a keel, it can only drift with the wind. Add a keel, and suddenly the boat can cut across the water, even sail against the wind. Spiral Theory adds that keel to your financial life. By introducing a third dimension—treating debt as a negatively correlated asset—actual returns can move closer to expected returns.

History shows that transformative ideas are often simple. The wheel, the lever, the keel of a boat—none are complex, but all changed the trajectory of human progress. Spiral Theory™ is similar. It reveals that volatility drag, long accepted as an unavoidable cost like gravity, can be managed. Through the Quantity of Money™, volatility itself becomes a source of energy that can be systematically harvested.

The conclusion is profound: by adding this third dimension, Spiral Theory™ reframes the way we look at every aspect of personal finance. It introduces a new field of thought—Balance Sheet Architecture™—that integrates assets, liabilities, and strategy into one cohesive design for building and protecting wealth.

The cost of risk

Problem

Most investors are familiar with the idea of risk, but few fully grasp how volatility quietly erodes long-term returns—even when average returns look strong. This effect, known as volatility drag, stems from the gap between arithmetic return (the simple average) and geometric return (the compounded result over time).

For example, with a 10% expected return and 20% standard deviation: 10% – ½ × (20%)² = 10% – 2.00% ≈ 8.00%.

That 2.00% gap is the hidden cost of volatility. The more volatile the returns, the lower your long-term growth—even if the average return stays the same. This cost is inescapable. Diversifying to reduce it comes with tradeoffs. And for those focused only on absolute returns? VD will be a costly lesson—crude, but memorable, and mathematically correct.

As wealth grows, risk isn’t just important—it becomes a primary determinant of return.

The option value of the option to borrow

Opportunity

The after-tax investor holds liquid capital—and with it, the option to borrow. This borrowing right functions like a perpetual American call option with no cost. It can be exercised anytime (American), never expires (perpetual), and costs nothing to hold. That flexibility is not theoretical—it’s real and powerful. It allows the investor to lever, derisk, or rebalance without taxes or forced sales.

The ability to borrow is not just convenient—it’s a key source of economic advantage. The option to borrow is profoundly valuable.

Formally, the value of this option is “infinitely valuable.” With no cost to waiting, no time decay, and no interest or dividend drag, the option’s theoretical value is unbounded. But when should it be exercised and why?

An offset

Solution

Volatility drag arises because the compounding of returns is reduced by variance—mathematically, the gap between arithmetic and geometric return is a function of σ². The option to borrow, surprisingly, shares the same σ² foundation. This is why the two can offset one another.

The algebra may look complicated, but the symmetry is so strong that even an 8th grader can see the similarity when the formulas are placed side by side. Stripped down, what seems like a maze of steps simplifies to a true/false statement: the terms cancel, and the relationship holds.

Critically, the borrowing function lags the drag. This means it is not “market timing.” The decision to act comes only in response to an event—a lag of expectations. In a frictionless environment, unconstrained by behavioral or institutional limits, debt can therefore be used to neutralize volatility drag.

Here, debt is not a lever for growth but a stabilizer for compounding efficiency. The framework is simple: when actual return falls below expected, borrow to buy risk assets; when actual exceeds expected, use gains to repay debt.

The Value of Debt

Value Creation

Over 30 years—or across a lifetime—the compounding effect produces materially different financial outcomes, even under identical risk and return assumptions.

In traditional model-based portfolios—such as a static 50/50 allocation—strategic use of debt may reduce volatility drag and restore risk exposures, adding an estimated 100 basis points annually. For investors following an outcome-based strategy with full equity exposure and dynamic reallocation, that benefit can exceed 200 basis points. In either case, these gains are not incremental—they are exponential.

Traditional rebalancing is often estimated to add about 50 basis points of return per year, although the size and persistence of this effect remain debated. The compounding cost of volatility drag, however, is well documented. In the illustrative example on this page, Spiral Theory produces a return enhancement of roughly 200 basis points; in the accompanying academic paper, the enhancement is approximately 150 basis points. Depending on assumptions, the modeled effect ranges from about two to eight times the impact of conventional rebalancing. Expressed in lifetime terms, improvements of this magnitude can translate into the equivalent of more than a decade of additional working years for a typical household — underscoring the potential importance of the framework rather than predicting a specific outcome.

Why: Assuming stochastic mean reversion or Brownian motion with drift, this strategy reduces return variance around the compounding path. Over time, actual returns converge toward expected returns, lowering volatility drag and enhancing geometric compounding.

Volatility drag is a convex cost—caused by variance, not loss. Strategic borrowing during periods of underperformance mirrors the payoff structure of a long volatility option. It transforms volatility from a drag into a source of gain.

This is not leverage to amplify returns, but conditional reallocation to preserve compounding integrity. The concepts are inversely related:

-

Volatility drag is a cost from variance.

-

Option-like borrowing is a volatility harvest.

When borrowing is deployed systematically it acts as a negatively correlated asset.

The result: reduced dispersion, stabilized growth, and improved path-dependence.

Always present vs. path dependent

Drag vs. Sequence

To some, this looks like a way to manage sequence of return risk. While the two concepts are similar, they are distinct. First, we will define each and then compare and contrast.

Volatility Drag

-

Definition: The gap between arithmetic and geometric mean returns caused by variance in returns. Even if returns are normally distributed, compounding makes the long-run realized return lower than the simple average.

-

Mathematical source: For returns with mean μ and variance σ², the expected geometric return ≈ μ − ½σ². The drag is proportional to variance.

-

Key feature: Always present when volatility > 0, regardless of whether cash flows in or out. It is a property of compounding itself.

-

Example: A portfolio that gains 10% one year and loses 10% the next has an arithmetic mean return of 0%, but the actual outcome is −1%.

Sequence of Returns Risk

-

Definition: The risk that the order in which returns occur affects wealth outcomes, especially when contributions or withdrawals are happening.

-

Mathematical source: Path dependence arises because cash flows interact with returns; the same set of returns in a different order produces different outcomes.

-

Key feature: Not universal—only matters when money is added or withdrawn. For a buy-and-hold investor with no cash flows, sequence risk disappears, while volatility drag remains.

-

Example: Two retirees each experience the same 20-year average return, but one suffers losses in the first three years while drawing income. That retiree risks depletion, even though the average return matches the other.

Compare & Contrast

-

Both arise from the nonlinearity of compounding.

-

Volatility drag is systematic: it applies to any volatile return stream and lowers long-term growth relative to the mean.

-

Sequence risk is situational: it emerges when the investor’s time horizon and cash flows collide with volatility, amplifying its impact.

Analogy:

Volatility drag is like gravity—a constant, universal pull that always reduces the trajectory of returns. Sequence risk is like a storm—dangerous only if you are trying to take off or land at the wrong time. Both stem from the same forces, but one is ever-present while the other is highly path-dependent.

Example: Consider a five-year return sequence for a portfolio with an expected return of 10% and a standard deviation of 20%. The actual returns over each year are as follows: Year 1: +30%, Year 2: −30%, Year 3: +20%, Year 4: 0%, and Year 5: +30%. The arithmetic average return is calculated by summing the annual returns and dividing by the number of periods: (30% -30% +20% + 0% + 30%) / 5 = 10%.

Despite an arithmetic average of 10%, the geometric return—the return that actually compounds wealth—is only 7.29%, illustrating the impact of volatility drag. The dispersion and sequencing of returns, not just their average, determine long-term outcomes.

Put simply: the investor earned an average return of 10% after fees. Arithmetic suggests an ending value of $161, yet due to volatility drag, the actual result is just $142. This gap compounds logarithmically, widening over time.

All but 100% cash investors

Applicability

Investors plan on averages. They anchor their goals to expected returns, but compounding ensures that actual returns almost always come in lower. This is volatility drag: the gap between what you expect and what you get. Unless your plan adjusts for it, underperformance is mathematically guaranteed. This is why financial planning today leans on probabilistic language—“You have an 80% chance of success.” In truth, what that means is 100% certainty you will not hit your target exactly: you will end with either more or less.

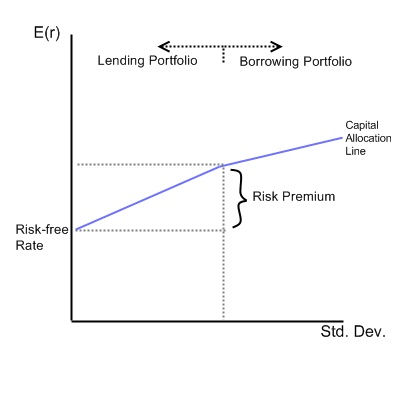

Under Modern Portfolio Theory, debt is reserved for the most aggressive investors—those who first commit 100% of their assets to equities (or their interpretation of the tangency portfolio). This logic aligns with conventional wisdom: debt is risky and belongs at the far end of the spectrum.

Spiral Theory reframes the issue. Every investor—except those holding 100% cash—faces volatility drag and can therefore benefit from the episodic use of debt.

To believe in rebalancing but not in rebalancing against the Quantity of Money™ is inconsistent. Spiral Theory shows that debt, carefully applied, functions as a negatively correlated asset—an instrument that offsets risk rather than amplifies it. By overlaying point-in-time models with over-time outcomes, Spiral Theory reveals that this is not just a tool for the aggressive few, but a framework relevant to all investors.

Force : Counterforce

Inspiration

Modern Portfolio Theory is built on two dimensions. Fix a goal, hold a static asset allocation, and project forward. The output is not a path to your goal, but a distribution of outcomes—a Monte Carlo simulation that assigns probabilities. And yet, why do we accept this? In every other discipline where stability matters, three dimensions are required.

A gyroscope does not balance on two axes. Its stability comes from a third—angular momentum—that resists external shocks and allows orientation to be preserved. Without it, autopilot systems in aircraft or self-driving cars would be impossible.

A tuned mass damper, suspended high in a skyscraper, reduces oscillations not with two points of reference, but with three: the structure, the force applied, and the counterforce moving against it. Remove one, and stability is lost.

A boat without a keel cannot chart a reliable course. With three dimensions of stability—the sails, the hull, and the keel—it can move not only with the wind but against it, crossing oceans with precision. The keel does not eliminate volatility in the water; it channels it into forward motion.

Finance, uniquely, still insists on two. Investors are told to accept a probability of “success” somewhere along a distribution of outcomes, as if setting out for New York and landing “somewhere on the East Coast” were good enough. The irony is sharp: physics, engineering, and navigation demand precision; finance defends imprecision as if it were a virtue.

The deeper inconsistency is definitional. MPT treats risk as variance—σ²—rather than as the probability of an unfavorable outcome. Under this definition, a portfolio with a 99.996875% chance of producing more wealth can still be labeled “risky” simply because its variance is higher. This is disingenuous. It conflicts not only with common sense but with the very purpose of financial planning. For 99.9% of society, risk is the chance of ending with less, not the abstract statistical property of fluctuating around a mean.

Other fields have recognized that known forces—wind, solar, waves—can be systematically harvested. These forces are stochastic, but not useless; with the right design, they become consistent energy sources. Volatility is no different. It is not merely noise; it is energy. By disregarding outcomes, and by refusing to incorporate the third dimension—the ability to control the Quantity of Money™—MPT is not merely incomplete, it is structurally misleading.

The inspiration for Spiral Theory™ lies in this gap. Just as simple differential equations underpin gyroscopes, dampers, and sails, the mathematics of Spiral Theory™ shows that borrowing, used episodically, can offset volatility drag. The elegance is in what has been overlooked: outcomes can be stabilized, probabilities reshaped, and wealth directed to its destination with far more precision than MPT allows.

Thrree elements for autopilot to function

Point in Time vs. Over time

Volatility drag is the gap between what an investment appears to earn on average and what it actually compounds into over time. In a straight, uninterrupted rise—bitcoin from 10,000 to 100,000 or the S&P 500 from 1,000 to 5,000—this gap effectively disappears: the arithmetic and geometric returns coincide. A snapshot of two endpoints shows no volatility; it only records the start and the finish. Yet a +50% gain followed by a −50% loss leaves the investor at 75% of the starting value, a real loss even though the simple average of +50 and −50 is zero. Both statements are true. The first describes an endpoint-only path with no fluctuation; the second exposes the compounding penalty that emerges when returns vary. One picture suggests no movement and no drag; a sequence of pictures reveals movement and thus drag.

This observation is not unique to finance. A single measurement can conceal dynamics that only become visible across time. Volatility drag is therefore not “time-based” in the calendrical sense; it is a mathematical consequence of variance and sequence—of motion. Time-based checkpoints may be useful in practice, but they are implementation choices layered on top of a path-dependent fact.

In any system where there is a desired endpoint, ongoing forces, and the potential for drift, you need at least three elements for an “autopilot” to function:

-

a fixed reference point (the destination, heading, or target),

-

a way of measuring motion and relative change between the actual state and the reference,

-

and a stabilizing or corrective mechanism that adjusts inputs as conditions change.

These same elements underlie Spiral Theory™. The fixed point is the investor’s goal, the forces are the fluctuations between risk-free and risky assets, and the stabilizing mechanism is the “quantity of money” adjusting as a function of movement. Whether the mechanism acts continuously or at discrete points—like a helm that trims constantly versus at set headings—is secondary to establishing that such a mechanism can, in principle, translate motion into progress by countering path-induced losses.

The proof that follows focuses on the mathematics: demonstrating that, given a fixed point, observable drift, and a rule that adjusts the quantity of money as a function of movement, the compounded result dominates the ungoverned path whenever variance is nonzero. Only after establishing this fact do practical choices—continuous versus point-based triggers, bands, frictions, and real-world constraints—enter the discussion.

Any risk, any rerturn, any time period

Proof & Simulation

In a frictionless environment, unconstrained by behavioral or institutional limits, debt can be used to neutralize volatility drag—the gap between arithmetic and geometric return caused by return variance. In this setting, debt functions not as a lever to chase higher returns, but as a stabilizer that preserves compounding efficiency.

The framework is simple:

-

When actual return < expected, borrow to buy risk assets.

-

When actual return > expected, use gains to repay debt.

For example, if returns fall below expectations, you borrow a quantity of money equal to the shortfall—essentially bringing your position back to “where you should have been.” If returns exceed expectations, you sell the excess to reduce debt or build cash reserves. This dynamic keeps the portfolio aligned with its expected trajectory.

The logic resembles the martingale strategy familiar in betting, with one critical difference: in gambling the expected return is negative, so the strategy guarantees ruin, whereas in financial markets the long-term expected return on risk assets is positive. That positive expectation is what makes the framework viable and value-creating over time.

Sample rule (no borrowing costs)

-

Volatility smoothing rule:

-

Target annual return= 10%

-

If actual return > 10%, move the excess to cash

-

If actual return < 10%, draw from cash to maintain the 10% growth path

-

If cash is exhausted, borrow to restore the 10% trajectory

-

No cost to borrowing, no interest drag.

-

This mechanism is in constant motion and, by design, incorporates a time lag: actions are taken only in response to realized outcomes, not forecasts.

Simulation

To make this concrete, we have created a custom GPT that allows you to simulate this framework using game-theory logic. It is called Flex. Adjust the assumptions, observe the outcomes, and test for yourself how episodic borrowing can offset volatility drag. Click here to play.

Why This Is Not Market Timing

Market timing seeks to anticipate future prices. By contrast, the framework responds only to realized outcomes. The borrowing rule is triggered when actual return falls below expectation, and the repayment rule is triggered when actual return exceeds expectation. In formal terms, the signal is endogenous and lagged—it depends on the path of realized returns, not on exogenous forecasts. This makes the mechanism reactive, not predictive, and places it within the logic of rebalancing rather than speculation.

Where Leverage Breaks Linearity

"The Gaussian Normal Paradox"

Before testing real-world frictions, it is useful to test theoretical ones.

Modern Portfolio Theory (MPT) rests on a set of elegant assumptions: asset returns are normally distributed, expected return and standard deviation are known, and investors can borrow and lend unlimited amounts at the risk-free rate. These conditions allow for the construction of the Capital Market Line (CML) and prescribe optimal portfolios as linear combinations of the risk-free asset and a risky market portfolio. Within this frictionless model, leverage is treated as a neutral scalar: borrowing 5% or 95% merely shifts return and volatility proportionally. Bankruptcy does not exist. The math holds—indefinitely. Yet this symmetry is illusory.

In practice, leverage introduces structural discontinuities. Borrowing 5% against a diversified portfolio is categorically different from borrowing 95%. Real-world constraints—margin calls, liquidity limits, behavioral reactions—make high leverage path-dependent. Negative borrowing may exist in theory, but not in practice. And critically, under the same Gaussian assumptions that make MPT analytically tractable, one can quantify how quickly risk accelerates as leverage increases—even before departing from the model.

This is the Gaussian Normal Paradox: even in a world of continuous rebalancing and normally distributed returns, leverage risk compounds nonlinearly. Over time, the risk of 5% leverage is fundamentally different from the risk of 95%. The relationship is not linear—it accelerates. This exposes an internal asymmetry within the very assumptions that give MPT its elegance and apparent rigor.

In plain English: In theory Tobin’s line is straight. In reality, that makes no sense when measured in outcomes. Borrowing 10% has a virtually zero probability of producing a bad outcome and a high probability of enhancing returns. Borrowing 90% has a near certainty of catastrophic loss, yet MPT still categorizes it as a “higher expected return.” Borrowing has clear and obvious limits. The question is not whether those limits exist, but how to rigorously test them—even within the Gaussian framework that assumes otherwise.

It is straightforward to model the impact of different leverage ratios to see the dramatic difference between borrowing 10% and borrowing 90%. To illustrate this, we created an interactive simulation called Spiral. Click here to play.

You can adjust the inputs and leverage ratio, then simulate a series of “turns” to observe outcomes. To be clear, the point-in-time model of MPT always holds. What Spiral helps visualize is the over-time outcomes of leverage, using the very assumptions of MPT. The simple constraint being revealed is that borrowing is not infinite—there is always a point of consequence (a “bad” outcome such as a margin call or bankruptcy). You can adjust how you define “bad,” but the principle remains: small amounts of debt carry less risk over time than large amounts of debt, which aligns with both mathematics and intuition.

Risk in dual states

Superposition

The linear model of Modern Portfolio Theory always holds at a point in time. At that measurement, additional debt is always classified as riskier. However, simple simulations reveal vast differences in outcomes when considered over time. Measured in outcomes, small levels of debt do not increase the expectation of risk; they increase the expectation of wealth. To be sure, debt is risky—but one can set any desired confidence interval (for example, 99.99685% confidence of a better outcome), which few would regard as “risky” in the ordinary sense. Conversely, large levels of debt do not lead to an expectation of higher returns; they lead to an expectation of ruin. The question becomes: how do we reconcile this mathematically and visually?

In quantum mechanics, superposition describes how a particle can exist in two states simultaneously until observed, as illustrated by Schrödinger’s cat. Spiral Theory applies the same logic to finance: risk can exist in two states at once. A point-in-time model may show an action as risky, while an over-time model, using the same assumptions, may reveal that it consistently improves outcomes. Both perspectives are valid; the insight comes from holding them together.

Spiral Theory™ does not replace the linear models of Modern Portfolio Theory. Rather, it overlays them with an additional transparency. Using identical inputs—expected return, standard deviation, and normally distributed returns—it produces two simultaneous views of risk. The first view is the familiar linear capital allocation line, valid at a point in time. The second view is a curved path, reflecting the compounding of outcomes over time.

Mathematically, the difference between these two views is the gap between the arithmetic and geometric mean. Under normally distributed returns, the expected arithmetic return is μ, while the expected geometric return is approximately μ − ½σ². The curvature arises directly from this variance term: the same σ² that underlies volatility drag.

It is therefore hypothesized that debt can be modeled within this framework as existing in superposition—simultaneously risky in a point-in-time view, yet risk-reducing when outcomes are considered over time. The overlay of these two transparencies does not yield a proportional curve, like a circle, but exhibits spiral-like characteristics. The Spiral thus emerges as the visualization of this duality: a consistent overlay of the Gaussian normal distribution onto time. It is not a rejection of MPT’s assumptions, but an extension—an added dimension that preserves their rigor while expanding their explanatory power.

Spiral Theory™: As Initially Hypothesized

Note from Tom: You may download the original paper. This is how I first envisioned the Spiral. I still like to teach it with this visualization because the curvature of risk is simple to understand—intuitive and instructive for both investors and professionals. Yet, for reasons too detailed to list here, there are many academic problems with this presentation and the initial version of the paper.

Ironically, working through those criticisms led to some of the most important discoveries in Spiral Theory™.

The big picture is this: the collapse of the original model led to a proven left side (the cost of volatility drag), a speculative or hypothesized right side (the Spiral curve itself), and eventually the recognition that not all debt is the same—distinguishing portfolio debt from structural debt, and strategic from tactical use of debt. That is a lot to unpack, so let me explain...

The irony: the spiral is the least important part of Spiral Theory

Spiral Theory™: as Updated

Spiral Theory™ raises an important question: could a small amount of constant leverage act like a “free lunch” by improving outcomes over time? At first glance, the answer appears to be yes. For example, if stocks are expected to return 10% a year with 20% volatility, borrowing 30% more would lift the expected return to 13%. Over time, this translates into an “actual” return of about 9.6%, compared with only 8% if you never borrowed.

So is the free lunch real? Yes and no. The leveraged portfolio grows faster than the unleveraged one, but it still falls short of its expected return. Volatility drag—the penalty from ups and downs—rises faster than the boost from borrowing. The result is that more leverage eventually hurts, not helps.

Ironically, the most important part of Spiral Theory™ is not the Spiral itself (the right-hand side), but the left-hand side: the cost of volatility drag and the enormous value in solving it. In some ways, if the framework were renamed today, it might not be called Spiral Theory at all. The exact spiral mathematics remain elusive and hypothetical, and the image distracts academics. Yet for professionals and investors alike, the Spiral is indispensable—it provides a simple and intuitive visual representation of how risk and outcomes bend over time.

The elegant discovery is that Modern Portfolio Theory was right all along at a point in time: Tobin’s straight line holds. But over time, outcomes fall below the line by exactly the cost of volatility drag. Spiral Theory™ reframes the challenge: can debt be used episodically, not perpetually, to cancel drag and recover this gap?

The Free Lunch Hypothesis (Mathematical Form)

Let risky-asset arithmetic return be μ and volatility σ, with normally distributed log-returns. For constant leverage L financed at the risk-free rate r_f, the arithmetic return is:

μ_L = r_f + L(μ − r_f), σ_L = Lσ.

The over-time (geometric) growth rate is:

g(L) ≈ μ_L − ½σ_L² = r_f + L(μ − r_f) − ½L²σ².

The vertical gap between μ_L and g(L) is:

Δ(L) = μ_L − g(L) = ½L²σ².

This gap is volatility drag. It scales quadratically with L.

A numerical example makes the point crisply. With μ=10%, σ=20% (σ²=4%), and r_f=0:

-

Unlevered (L=1): g(1) = 10% − ½(0.20²) = 8%.

-

Levered (L=1.3): μ_L = 13%, σ_L = 26%, g(1.3) ≈ 9.62%.

Thus 9.62% > 8% (small leverage raises geometric return), yet 9.62% < 10% (actual still falls short of expected). More leverage only enlarges Δ(L).

The conclusion is elegant: the point-in-time Capital Market Line is reaffirmed; over time, a shadow CAL sits Δ(L) below it. Spiral Theory™ does not seek to beat the line with perpetual leverage, but to neutralize Δ(L) episodically. Debt, used as a negatively correlated asset, could reduce the variance penalty itself—bringing actual returns closer to expected returns.

For academics, this is why the presentation shifts. Sharpe, Tobin, and Markowitz remain untouched: the Capital Market Line is still valid at a point in time. The shadow CAL is not higher; it is lower, representing the cost of volatility drag. The innovation lies in showing how option value—exercised episodically—can offset this drag. The mathematics are simple, elegant, and rigorous. We consider the possibility to neutralize volatility drag an identity, the theory lies in the constraints.

The Spiral Returns

Real World Constraints

How Much Can One Borrow, Confidently?

Academics, professionals, and individual investors often use the word “risk” to mean very different things. As a result, one question can produce three very different answers: how much leverage is safe?

The keel analogy helps. When building a boat, one naturally wants to know how far the vessel can lean without capsizing. But that answer depends on conditions. In theory, on calm seas, a hull can tolerate a much greater angle of heel than most sailors could stomach in practice. In a storm, the margin narrows further. Finance is no different. Under a Gaussian normal distribution, you can define a risk event and calculate your borrowing capacity precisely. If the distribution is not normal, you can still apply your own assumptions for return, volatility, and tail risk to simulate outcomes. Our AI tool can help you run these simulations.

Outside of testing, a practical framework is needed. Consider an investor with $1 million, 100% in equities, with an expected return of 10% and a standard deviation of 20%. If the market declines 10%—a 20% variance from expectation but still within one standard deviation—the portfolio is now $900,000. Restoring the portfolio to its expected trajectory requires borrowing $200,000. Borrowing after a 20% decline is far less risky than after a 20% rise, but it is still a significant lean. If the first move after borrowing is down rather than up, and there is no cash reserve, then 100% of the offset must come from additional borrowing. Moreover, if the portfolio was already leveraged before the correction, capacity to respond is reduced.

For comparison, a 70/30 investor might be down only 7%, to $930,000. To restore their expected 7% return trajectory, their required borrowing is $140,000.

Thus, while the theoretical limits can be debated, for most investors the practical range of safe episodic borrowing is about one, possibly two, standard deviations. This makes episodic borrowing a powerful normalizer of “normal” market movements, but it does not solve for extreme events like 2008 or the Great Depression. What it does is open a path to modeling how such events could be addressed.

A more complete picture

Introducing: Total Economic Value™️

In corporate finance, Enterprise Value represents the market value of a firm’s equity plus its debt, minus excess cash. It is the measure used to value a business as a whole—the total resources under management, regardless of capital structure. Personal finance has no equivalent term. Investors are taught to focus on “net worth” or “asset allocation,” but these capture only one side of the balance sheet.

Spiral Theory introduces Total Economic Value™ as the missing metric for individuals. It combines all assets and liabilities—financial and non-financial—into a single, integrated view of the resources an individual controls. Like enterprise value, it is indifferent to how those resources are financed. It is the true base from which consumption, investment, and risk decisions should be made.

This matters because, for some odd reason, the worlds of personal finance and corporate finance are virtually disconnected academically. There is no bridge between Modigliani–Miller’s insight on capital structure and Modern Portfolio Theory’s focus on asset allocation. In reality, consumption—buying a house, a car, or even retiring—is central to household finance. In theory, all borrowing is assumed to occur against a portfolio. In reality, most borrowing is secured by other assets, such as a home. A mortgage is permanent debt, not subject to a margin call. In theory, all assets can be levered. In reality, retirement accounts cannot.

It is little wonder, then, that most people and even professionals do not engage deeply with financial theory. This is tragic, because Markowitz, Sharpe, Tobin, Fama, Shiller, Merton, and others have taught profoundly important lessons. But without a bridge to consumption, to Modigliani–Miller, and to balance-sheet design, those lessons fragment. We are far from the only observers to note this flaw. But we are among the few working to bridge the gap academically—linking the principles of corporate finance and personal finance into a single, coherent framework.

Academic Note:

In canonical MPT (Markowitz, Sharpe, Tobin), consumption is treated as exogenous; investors maximize expected utility of final wealth under mean–variance assumptions. Robert Merton’s intertemporal consumption–portfolio model was the first to make consumption endogenous, linking optimal portfolio choice to lifetime spending preferences. Spiral Theory builds on that spirit but diverges in two key ways. First, it frames Total Economic Value™ as the household analogue to enterprise value, explicitly uniting assets and liabilities into a single measure. Second, it integrates Modigliani–Miller–style capital-structure thinking into personal finance by analyzing how episodic debt—an option layered on top of Total Economic Value™—can be used strategically (“Merton Share” borrowing). In this sense, Spiral Theory™ is not a rejection but a bridge—connecting Merton’s insight on consumption with Modigliani–Miller’s insight on leverage, and making both operational for individual balance sheets.

You can’t rebalance against your house™

Understanding Total Economic Value™️

Consider two individuals, each with a net worth of $4 million. Person A holds a $2 million portfolio and owns a $2 million house outright. Person B holds a $4 million portfolio, owns a $2 million house, and carries a $2 million mortgage. Even if their portfolios have the same expected risk and return, their outcomes will differ—for better or for worse. This is not conjecture; it is a mathematical fact. This framework is exogenous to Modern Portfolio Theory but central to the outcomes of every investor.

Most people think of leverage only as a way to enhance returns. Spiral Theory™ asks a different question: what if the Quantity of Money™ were used as a defensive measure? In the example above, the household could own its home outright—but instead chooses to borrow 100 percent at a floating, interest-only rate and invest the proceeds in Treasuries. This is entirely feasible; interest-only, floating-rate loans exist and are frequently used among the wealthy. For our simple illustration, assume the cost of debt is equal to the rate of return on cash.

Earlier we showed that debt can function as a negatively correlated asset. This is a mathematical fact: it can smooth returns and reduce volatility drag, aligning actual returns with expected returns. The effect is to create a financial “gyroscope” that absorbs normal market movements. This alone can add roughly two percentage points annually—transforming outcomes by extending portfolio longevity and enabling greater lifestyle flexibility. It cannot, however, absorb major shocks early in retirement. And while the theoretical limits of borrowing may be high, the “lean” becomes uncomfortable and factually risky from both a point-in-time and an over-time perspective. This is why we need to look at how to protect against a 2008-style or Depression-level crisis—and why understanding Total Economic Value™ matters.

Now imagine a 50 percent collapse in global equity market capitalization on day one of retirement—an event without precedent in modern financial history. Equities fall to $1 million, but with $2 million in Treasuries in reserve, the investor simply rebalances back to their global equity target. Reserves remain strong; borrowing capacity untouched. If markets fall further, their relative wealth accelerates logarithmically—buying more future return at lower prices. Post-crash, they are arguably in a stronger position. That difference compounds. It is not incremental; it is transformational. Avoiding structural debt can achieve similar outcomes, but only by accepting unnecessary lifestyle sacrifice.

This is the essence of planning with both sides of the balance sheet. It helps explain why virtually all high-net-worth families use debt as a strategic tool. They could own their home outright—but choose not to. Why? Flexibility. This is not a rate play; it is a positioning strategy grounded in corporate finance: preserve optionality, maintain liquidity, and absorb shocks with structural tools. In this case, the strategy functions as a costless, perpetual put—fully hedging downside without reducing upside.

If the world were frictionless, Total Economic Value™ would not matter. But it is not—so it does. You can’t rebalance against your house™. Most people do not understand what a costless put is—or why it matters—but they should. Under options pricing theory it can be infinitely valuable. One mindset says, “If the world goes to zero, I own my home.” The other says, “If the world goes to zero, I own the world.” You are the architect of your future balance sheet.

Exploring these mathematical truths lays the foundation for Balance Sheet Architecture™ and Outcome-Based Planning.

Discover how we can help you